Aterio’s Report on US Data Center developments, June, 2025

Sergio Toro

In May, satellite imagery analyzed by Aterio provided critical visibility into the actual progress and delays across major U.S. data center campuses. While many projects continue on schedule or ahead of pace, others are showing signs of strategic pause or reassessment:

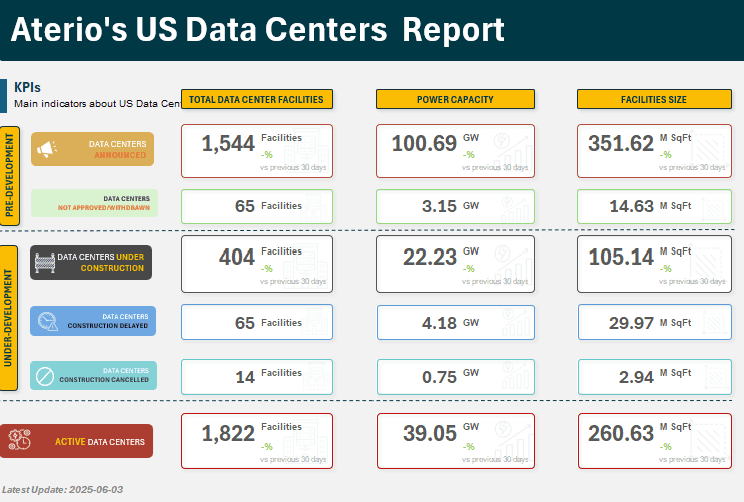

Total Active Data Centers in the US: 1,822 Buildings

Total Data Centers under Construction: 404 Buildings

Total announcement for new data centers: 1,544 Buildings

South Hill, Microsoft Campus – Project Appears Paused (144 MW Planned)

As of May 2025, no construction or equipment activity was observed at a site initially graded and foundation-ready back in February 2024. Despite the first facility being partially operational (running at half capacity), the rest of the campus—which was planned to scale up to 144 MW of critical IT—remains idle. This may indicate a strategic pause or reprioritization from the developer.

St. Joseph, AWS Campus – Aggressive Acceleration Toward 1 GW

Aterio’s satellite image analysis confirms simultaneous construction across multiple buildings at a 16-facility campus in Indiana—one of the most ambitious developments in the country. With $11 billion committed and originally expected to reach up to 2.25 GW, the Aterio team estimates at least 1 GW of capacity will be online by Q3 2026. The pace of work reflects a clear intent to accelerate AI-ready infrastructure, now considered Indiana’s largest capital investment to date.

Maiden, Microsoft Campus – Quiet Site with Signs of Expansion

While the Microsoft campus in Maiden, NC shows limited vertical construction and appears idle at foundation stages, satellite imagery analyzed by the Aterio team suggests more buildings are under preparation than previously disclosed—potentially expanding from 2 to 5 structures. This points to future growth beyond public filings, even if construction appears temporarily staggered.

Stargate, Phase 2 – High-Density Build Targets 2026 Launch

Construction is actively underway at the Stargate Phase 2 campus, where six structures—each composed of four buildings—are being built simultaneously. Each building is estimated at 125,000 sq ft with 37.5 MW of power capacity, designed to support 12,500 Blackwell GPUs per building. The entire phase is targeted to go live by Q4 2026, reinforcing the trend toward GPU-optimized, high-density campuses to meet escalating AI workload demands.

Google Revealed as Backer of $10 Billion West Memphis, Arkansas Campus

A massive data center project in West Memphis, Arkansas, originally announced by an undisclosed developer in 2024, is now understood to be backed by Google. With a $10 billion investment, it represents the largest economic development initiative in the city’s history. While no official figures on square footage or power capacity have been released, Aterio estimates the campus will include five buildings totaling approximately 1.4 million sq ft and deliver up to 440 MW when fully built.

Amazon Expands in Loudoun County Near Strategic Energy Infrastructure

Amazon acquired nearly 100 acres of land near Philip A. Bolen Memorial Park in Leesburg, VA, just north of the 774 MW Potomac Energy Center—a natural gas power plant acquired by Blackstone Energy Transition Partners in January 2025. Satellite imagery places Amazon’s new parcel adjacent to a growing cluster of hyperscale infrastructure, positioning the company for future development near critical, dispatchable power. The proximity to Potomac suggests a strategic alignment between data center site selection and energy access, a growing trend as AI workloads drive energy intensity.

Soluna Expands HPC/AI Portfolio with Renewable-Powered Data Centers in Texas

Soluna Holdings, historically focused on crypto mining, is accelerating its shift toward AI and HPC infrastructure, with multiple projects underway across Texas. In May, the company formally launched Project Hedy, a 120 MW wind-powered facility in Cameron County. The project is part of a broader portfolio that includes sites like Kati (166 MW), Rosa (187 MW), and Annie (75 MW, solar)—all positioned for BTC, AI, or HPC hosting. With most sites in development or shovel-ready, Soluna is quickly emerging as a renewable-powered data center developer to watch in the AI compute race.

Georgia Activity Slows After April Peak

Georgia, the leading state in April with 77 announcements and over 5.1 GW of planned capacity, experienced a notable drop in May, logging just 12 projects and 823 MW. This decline could reflect a natural cooldown following an intense wave of filings, or emerging constraints around grid interconnection and land use near high-demand corridors like Atlanta and Augusta. It also suggests that while Georgia remains a top-tier market, developers may be temporarily pausing to align infrastructure timelines with power delivery and permitting processes.

Broader State Diversification Resumes

Unlike April, where activity was heavily concentrated in just a few states, May saw a broader geographic spread, with 10 different states reporting new announcements. Notable re-entries include South Dakota and Arkansas, both with strategic capacity filings. This signals growing developer interest in underutilized markets—especially those offering grid headroom, tax incentives, or proximity to renewables. The trend supports a longer-term playbook of distributing hyperscale and AI infrastructure across multiple states to mitigate local bottlenecks and diversify risk.

Texas Reclaims the Top Spot

After trailing Georgia in March and April, Texas surged to the top in May with 49 new announcements totaling over 3.7 GW of planned power capacity. This marks the highest activity level since January, when Texas recorded 53 announcements and 4.85 GW—signaling a strong return to early-year momentum. The uptick reflects sustained developer confidence, driven by the state’s abundant land, favorable permitting environment, and access to both renewable and dispatchable power. As demand for AI infrastructure ramps up, Texas is reasserting its position as a national leader in hyperscale and HPC-oriented development.

Explore detailed information on every active, announced, and under-construction data center in the United States.

Data centers in the United States - Aterio

( Full dataset, available in EXCEL, TABLE, CSV or JSON)